How Does Payment Processing Work?

Most business owners understand the basic concept of transaction fees but may still wonder exactly how payment processing works. There are many different types of rate structures, each with pros and cons. Before diving into the differences between each pricing structure, first we need to understand which fees are negotiable and which are hard costs.

When a card payment is made, funds travel from the issuing bank of the credit or debit card (Capital One, Chase, American Express, etc.) to the processing bank (known as The Merchant Processor, Merchant Bank, or Acquiring Bank) before being deposited into the business bank account.

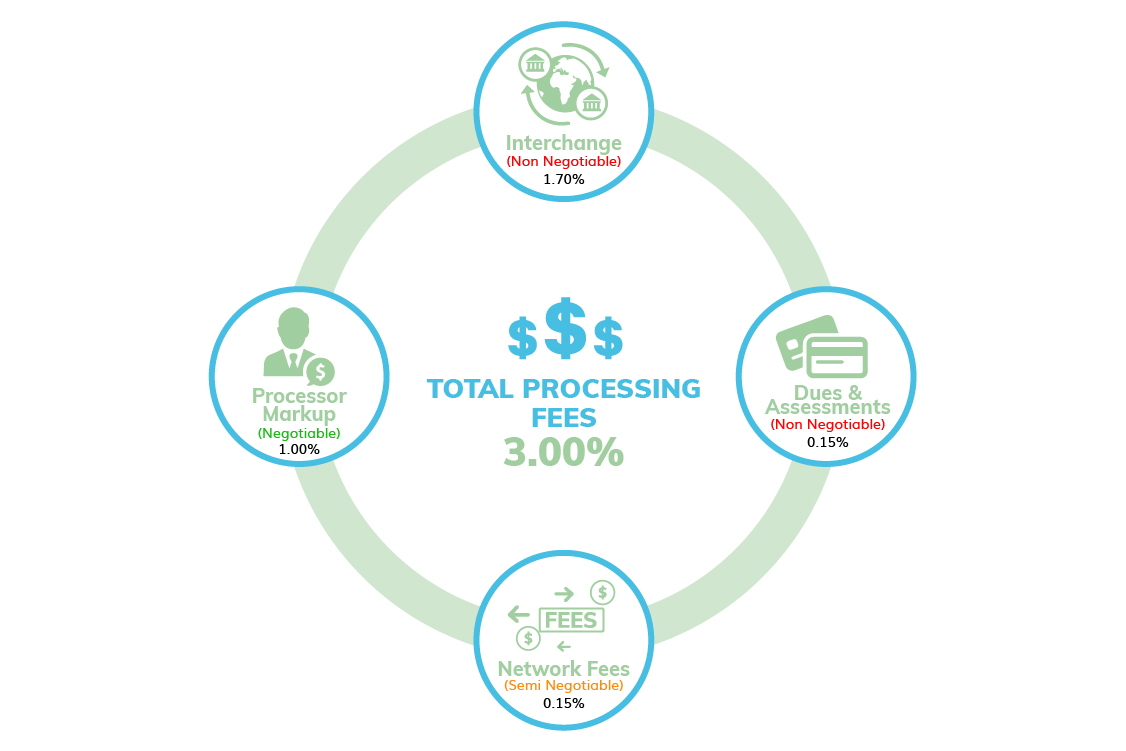

Each credit card payment that is accepted by a business is comprised of four primary fees. Interchange, Dues and Assessments, Network Fees, and Processor Markup.

These four make up the total processing rate that a business pays to accept credit cards.

Interchange and Dues and Assessments are non-negotiable fees that every business in the United States pays regardless of their size.

Network fees have a cost that ranges from $0.015 to $0.04 for transaction depending on which authorization and settlemnt network you use. This fee is usually inflated to $0.10 or more per transaction and the difference is paid to the processor.

The Processor Markup is completely negotiable and is the most important figure to know in order to get your processing fees as low as they can possibly be.

Interchange or Issuing Bank Fees (Non-Negotiable)

The issuing bank is the bank that issues the credit or debit card. Typically the issuing bank earns the largest portion of the fees associated with accepting card payments unless the processor markup is very high.

Each credit or debit card has a unique rate attached to it that is set by the card brands (Visa, Mastercard, American Express, etc.) and is paid to the issuing bank.

As another quirk of how payment processing works, there is usually a difference in the interchange rate based on whether the card is present (swiped, read, or tapped) or not present (keyed in or processed online). Cards that have rewards, such as cashback and airline miles, also have higher interchange rates. You can download the most up-to-date interchange rates on the card brand websites for Visa, Mastercard, and American Express.

Here are some common interchange fees earned by the issuing banks.

VISA

| Card Type | Card Present | Card Not Present |

| Debit | 0.05% + $0.21 | 0.05% + $0.21 |

| Retail Credit | 1.55% + $0.04 | 1.80% + $0.10 |

| Credit Retail Rewards | 1.65% + $0.10 | 1.95% + $0.10 |

Mastercard

| Card Type | Card Present | Card Not Present |

| Debit | 0.05% + $0.21 | 0.05% + $0.21 |

| Credit | 1.58% + $0.10 | 1.89% + $0.10 |

| Retail | 1.05% + $0.15 | 1.60% + $0.15 |

American Express

| Business Type | Transaction ≤ $500 | Transaction > $500 |

| Retail | 1.60% | 2.00% |

| Restaurant | 1.60% | 2.40% |

| Mail Order/ Telephone Order | 1.60% | 2.00% |

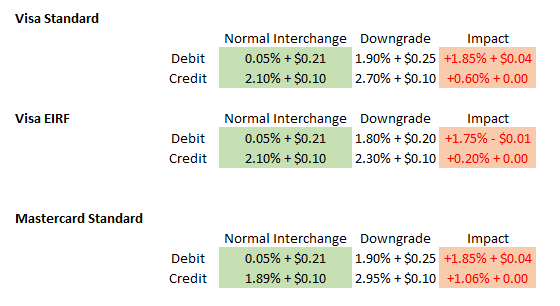

There are also different “levels” of interchange that are commonly referred to as “downgrades.”

An interchange downgrade occurs when a merchant does not qualify for the lowest possible interchange for the card that is being transacted. Understanding downgrades is crucial to learning how payment processing works.

Downgrades can happen in a number of scenarios, some of the most common being:

- Cards that are not settled within 24 hours of being authorized.

- Cards that are keyed in to a terminal for a merchant that has been underwritten and identified as a Retail (Card Present) account.

- Keyed-in cards that do not have matching information with the issuing bank such as Address Verification (AVS), usually just requiring the house number and zip code.

From the standpoint of a business owner, a downgrade feels like a surprise fee—all of a sudden, processing becomes more expensive! The impact of the downgrade varies but can be very significant. Each card brand has its own downgrade labels.

Visa has two common interchange downgrades that are called “Standard” and “Electronic Interchange Reimbursement Fee (EIRF).”

Mastercard typically downgrades to just “Standard.”

As you can see from this example, downgrades can have a significant impact on your overall credit card processing fees. If a lot of “Standard” and “EIRF” language appears on your merchant statement, it’s important to find out exactly why this is happening from your merchant processor and make changes if necessary to eliminate these downgrade fees.

Dues & Assessments or Brand Fees (Non-Negotiable)

The card brands Visa, Mastercard, American Express, and Discover charge network and assessment fees for each transaction that is processed under their respective brand. These fees can differ from business to business based on the Merchant Category Code (MCC)—which is the type of business the merchant operates—the number of locations the business operates, and the total volume of credit cards that are processed.

So how does payment processing work in this scenario? There are many fees that can be charged, and many of them are in special circumstances. For example, if the card is foreign, not present, or if the authorization is older than a specified period, the issuing bank will collect an additional fee. Here are some of the most common fees charged:

Visa

Visa Assessment Fee VAF (Debit)- 0.13%

This fee is charged on all cards that are branded by Visa. Debit is slightly cheaper than credit.

Visa Assessment Fee VAF (Credit)- 0.14%

This fee is charged on all cards that are branded by Visa. Credit is slightly more expensive than debit.

Acquirer Processing Fee AFP (Debit)- $0.0155

The Acquirer Processing Fee is a transaction-based fee charged on every transaction by cards branded by Visa. Debit is slightly cheaper than credit.

Acquirer Processing Fee AFP (Credit)- $0.0195

As mentioned in the merchant fee definitions above, this applies to every transaction. Credit is more expensive than debit.

Zero Dollar Verification Fee– $0.025

This fee is charged when a transaction is run for $0.00. Merchants may run “zero-dollar” transactions when the goal is to validate cardholder data, such as for the purpose of address verification or to confirm that the card is valid. Running a card for verification purposes with an amount of money that is never settled will incur a Misuse of Authorization fee, which is more expensive than a Zero Dollar Transaction, which is why a merchant may choose to verify the card that way. This is yet another example of why the definitions for merchant processing fees are important to understand. Business owners can choose the most cost-effective option when necessary.

Misuse Authorization Fee MAF- $0.09

The Misuse of Authorization fee is only charged when proper authorization protocol isn’t followed.

The Misuse fee applies to transactions that are:

- Not settled or reversed within 10 days from the time of sale

- Not settled or reversed within 24 hours if the order was submitted in error or canceled by the cardholder for card present transactions

- Not settled or reversed within 72 hours if the order was submitted in error or canceled by the cardholder for card-not-present transactions

Travel and entertainment merchants have 20 days before this fee applies, assuming the transaction was not canceled or run in error.

Zero Floor Limit Fee– $0.20

This fee is charged when a transaction is settled that does not have an authorization. This is an uncommon situation that won’t apply to the vast majority of business transactions.

Transaction Integrity Fee TIF– $0.10

This fee is charged when a debit or prepaid card does not qualify for the Custom Payment Service (CPS) program.

This usually occurs when:

- A transaction is not settled within two days of the authorization

- Address Verification Information is not included in card-not-present transactions

- E-commerce transactions do not include an order number

- Hotels do not include check-in and check-out data.

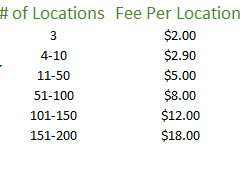

Fixed Acquirer Network Fee FANF- $2.00+

This is not a per-transaction fee. This is charged based on how many locations a merchant has, a merchant’s volume, and the amount of card-present vs. card-not-present transactions. Merchants that have between 1 and 3 separate locations pay a flat $2.00 per location.

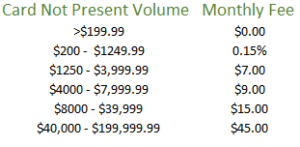

The FANF fee increases gradually until maxing out at $85 per location for companies that do very high volume and have thousands of locations. Card-not-present transactions have a fee assessed depending on the amount of volume processed. Here are some examples:

Credit Voucher Fee (Debit)- $0.0155

This fee is charged on all refunded transactions. Debit is slightly cheaper than credit.

Credit Voucher Fee (Credit)- $0.0195

This fee is charged on all refunded transactions. Credit is slightly more expensive than debit.

Base II Voucher Fee (Debit)- $0.0155

This is another fee charged for refunds. Debit is slightly cheaper than credit.

Base II Voucher Fee (Credit)- $0.0195

This is another fee charged for refunds. Credit is slightly more expensive than debit.

System File Transmission Fee– $0.0018

This fee is charged on all Visa transactions.

Kilobyte Access Fee KAF– $0.0047

This fee is charged on all authorizations that are submitted for settlement.

International Service Assessment Fee ISA– 0.80% – 1.20%

This fee is charged when a card is processed that was issued outside of the United States. The fee varies depending on the currency in which the transaction is settled.

International Acquirer Fee IAF– 0.45%

This fee is charged on cards issued outside of the United States, usually in conjunction with the International Service Assessment Fee. The total charge for both fees on international cards falls between 1.25% and 1.65%.

Mastercard

Acquirer Brand Volume– 0.13%

This fee is charged on the total volume of transactions processed that are equal to or less than $1000 per sale and for all debit transactions that exceed $1000 per sale.

Acquirer Brand Volume Credit over $1000– 0.14%

This fee is slightly more expensive for credit cards that are over $1000 per transaction.

Account Status Inquiry Service Fee– $0.025

This fee is applied when a merchant processes a credit card for $0.00 in order to verify that the card is valid, typically for use in future billing. Note that if a card is run with a nominal amount under $1.00 and then voided to verify its validity this is considered a Nominal Amount Authorization and is assessed a higher fee.

Processing Integrity Fee– $0.055

This fee is charged for transactions that are not settled within 24 hours of authorization for card-present transactions and 72 hours for card-not-present transactions.

Kilobyte Access Fee– $0.0035

This fee is charged for each settlement that is settled.

Mastercard Connectivity Fee– $0.0000079

This is a data fee that is charged per Kilobyte of data assessed on all transactions.

Acquirer License Fee– $0.0047%

This fee is charged on all processing volumes.

Merchant Location Fee– $1.25

This is a monthly fee that is charged per merchant location.

Account Status Inquiry Fee– $0.025

This fee is charged when a merchant verifies that an account is open and usually applies when establishing an automatic billing or recurring payment relationship.

Digital Enablement Fee– 0.02%

Mastercard charges this fee on all Card-Not-Present transactions. The digital enablement fee was increased from 0.01% to 0.02% in April of 2022.

Cross Border Fee– $0.60%

This fee is charged on all transactions that are settled in foreign currency where the card has been issued outside of the United States.

Global Acquirer Program Support Fee– 0.85%

This fee is charged in conjunction with and in the same scenarios as the Cross Border Fee.

Address Verification Fee AVS– $0.01

Mastercard’s address verification service allows a merchant to verify the address of record at the issuing bank for card-not-present transactions.

Network Access Brand Usage Fee NABU– $0.0195

Any transaction that settles through the Mastercard network is assessed the NABU fee. This fee is charged for settling each transaction.

Interchange Downgrade Fee– $0.15%

In addition to paying a higher interchange rate for transactions that are downgraded, the interchange downgrade fee is also charged on the total downgraded volume. This is another aspect of how payment processing works and a reason to avoid downgrades.

Excessive Authorization Attempts Fee– $0.10

This fee is charged when a merchant attempts to authorize a sale that has previously declined authorizations. The fee only applies after 20 authorization attempts on the same card within a 24-hour time window.

Nominal Amount Authorization Fee– $0.045

This fee is charged when a card is authorized for a small amount of money (less than $1.00) and then voided. Merchants will usually do this in order to verify a card, especially for future billing when the card is not present such as for subscriptions or rentals. To save money, a transaction should be run for $0.00 instead and be charged the Account Status Inquiry Fee.

Mastercard Pre-authorization Fee– $0.05%

The pre-authorization fee is charged when a sale is run with the intention of settling the transaction at a future date. The fee has a minimum of $0.01 charge.

Discover

Assessment Fee– 0.13%

This fee is charged on all Discover processing volumes.

Data Usage Fee– $0.0025

This fee applies to all Discover transactions.

Network Authorization Fee– $0.0195

This fee applies to all Discover authorizations.

International Processing Fee– 0.55%

This fee is charged on all cards that are processed in the USA that have been issued in another country.

International Service Fee– 0.80%

This fee is charged in conjunction with the International Processing Fee for the same reason.

Program Integrity Fee– $0.05

This fee applies to all transactions that have been downgraded into a higher interchange category.

American Express

Program Participation Fee– $0.12%

This fee is charged on all American Express volume that is processed by a company other than American Express.

Card Not Present Fee– 0.30%

This fee is charged for all card-not-present transactions.

Inbound Fee– 0.40%

This fee is charged on cards that have been processed in the USA that were issued outside of the United States. Canadian and Japan Credit Bureau (JCB) cards are excluded. Also, foreign-issued debit cards are not assessed this fee.

Merchant Conversion Fee– 0.30%

Merchants who previously used American Express as a payment processor will be assessed a merchant conversion fee if they begin processing Amex with a new payment processor. Speed of funding and overall pricing are major factors when processing with American Express directly. Speak with one of our experts for more information.

Network Fees (Semi-Negotiable)

The network is another merchant fees definition that is important for business owners to understand. You can think of a network as a road from the processing bank to the issuing bank. Networks serve two main purposes: the authorization of the payment and the settlement of the payment. There are many popular networks such as Vantiv, First Data, and Tsys. Separate from interchange and brand fees, networks usually charge an authorization fee and settlement fee (also called batch fee).

Each network charges a fee that typically ranges from $0.0195 and $0.04 per transaction. Processors commonly inflate the cost of this fee to $0.10 per transaction and keep $0.06 per transaction of profit. Businesses that run a lot of transactions every month are most effected by these fees.

Processing Bank Markup (Fully Negotiable)

The entity that you ultimately open a merchant account with is known as the processing bank. If you truly want to understand how payment processing works, it all starts with the processing bank.

The processing bank takes the risk on the merchant’s behalf and is in charge of making sure the merchant adheres to the rules and regulations of the networks and card brands. The bank must also make sure the merchant stays up to date with Payment Card Industry (PCI) compliance standards. They are also the merchant-facing entity that handles customer service and credit card processing equipment and integrations.

Understanding the role of the processing bank and other crucial merchant services definitions is essential to making informed decisions about your business. Currently in the merchant services space, the sales representative of the processing bank usually has complete discretion on what pricing to offer a merchant.

The sales representative frequently makes the bulk of the income generated by the processing bank with revenue splits anywhere from 50% to 90% of the total profit. With no clear pricing rules or guidelines, a processing sales representative is ultimately responsible for a merchant getting a good or bad deal in terms of what they pay for processing credit cards.

Rate Structures

Now that we’ve covered the basic merchant fees definition, we can dive deeper into the question of how does payment processing work by exploring the most common rate structures.

Interchange Plus+

Interchange plus pricing means all of the hard costs (Interchange, Dues and Assessments, and Network Fees) are passed through directly to the merchant, and then the processor adds a fee on top. This fee is usually quoted in terms of basis points. For example, if a processor quotes a rate of 50 basis points (.50%) they earn half of a percent on all the cards you process.

| Card Type | Interchage Cost | Plus Markup (Profit) | Total Rate |

| Debit | 0.05% + $0.21 | 0.50% | 0.55% + $0.21 |

| Credit | 1.55% + $0.04 | 0.50% | 2.05% + $0.04 |

| Credit Rewards | 1.65% + $0.10 | 0.50% | 2.15% + $0.10 |

| Monthly Volume | Processor Profit |

| $10,000 | $50.00 |

| $50,000 | $100.00 |

| $100,000 | $500.00 |

Besides the basis points, the transaction fee is most often the next largest source of revenue. The transaction fee hard cost differs between networks, but usually there is a spread between the quoted transaction fee and the network fee that the processor keeps. This revenue source is largest with merchants that run a high number of transactions.

Not included in our above example are many other fees that are usually charged such as Monthly Statement Fees, Monthly Minimum Fees, Batch Fees, and many others unnecessary fees that increase processor profit.

Pros

* Interchange pricing allows the merchant to see the amount of money the processor earns by multiplying the basis points (the plus in Interchange +)by their total processing volume.

Cons

* Processors have been known to inflate the interchange they report on the monthly statement, so you may have to compare the rates that are reported with the rates that are published on the brand’s websites.

* The statements are long and very detailed since they break down every hard cost that has been passed through. This can be very confusing and difficult to understand.

* The more money you process, the more money the processor makes. Essentially the processor owns a percentage of your business without making any investment. It’s important to calculate how these fees will impact sales to fully understand how payment processing works.

Tiered or Flat-Rate Pricing

In a flat-rate or tiered pricing structure, you typically pay either a flat percentage across the board for all cards or a tiered rate depending on the type of card or the method in which it is processed. Tiered rates are most often quoted in 3 or 4 tiers and may look something like this:

| Debit: | 1.00% |

| Qualified: | 1.89% |

| Mid-Qualified: | 2.69% |

| Non-Qualified: | 3.09% |

| AMEX: | 3.50% |

A qualified rate may include a retail card that is swiped, a mid-qualified rate may include a retail card that is keyed, and a non-qualified rate may include a rewards card that is keyed. Processors decide which card goes into each category.

One processor may consider a card as “qualified” while another may consider the same transaction as being “mid-qualified.” Discrepancies in these merchant fees definitions impact the transparency of this method.

Common processors like Square and Stripe use the flat-rate method to encompass all cards. For example:

Rate: 2.60% + $0.10 (Card Present)

Rate: 3.50% + $0.15 (Card Not Present)

By using the same table as we used in the Interchange Plus model, you can see that the flat rate processor’s profit fluctuates depending on the card accepted.

| Card Type | Interchage Cost | Processor Flat Rate | Processor Profit |

| Debit | 0.05% + $0.21 | 2.60% + $0.10 | 2.55% – $0.11 |

| Credit | 1.55% + $0.04 | 2.60% + $0.10 |

1.05% + $0.06 |

| Credit Rewards | 1.65% + $0.10 | 2.60% + $0.10 | 0.95% + $0.00 |

| Monthly Volume | Average Processor Margin | Processor Profit |

| $10,000 | 1.00% | $100.00 |

| $50,000 | 1.00% | $500.00 |

| $100,000 | 1.00% | $1000.00 |

Pros:

*Statements are short and much easier to read.

Cons:

* Pricing is not transparent.

* Pricing is usually expensive. Processors typically give themselves quite a bit of margin between the hard costs and the fees they charge. For example, a debit card of .05% that is charged at 1.00% gives 95 basis points of margin.

* The income of the processor is tied to the success of the business. The processor owns a percentage of the revenue the business generates, just like with interchange plus pricing.

Cash Discount Pricing

Cash discount is a method of pricing that allows a merchant to charge a lower price for items when a customer pays in cash. Typically, the merchant assesses a fee on all of their products and services, most often in the form of a “customer service fee”, and notifies the customer that they will give a discount on this fee for cash purchases. The fee is then taken out before the deposit is made into the business bank account instead of all the fees coming out at once at the end of the month. This effectively eliminates all processing fees.

| Transaction Size | Customer SVC Fee | Total Transaction | Net Deposit |

| $1.00 | 3.00% | $1.03 | $1.00 |

| $5.00 | 3.00% | $5.15 |

$5.00 |

| $25.00 | 3.00% | $25.75 | $25.00 |

Pros:

* Huge savings. Businesses effectively pay nothing in credit card processing fees.

* Flat rate statements that are very easy to read.

Cons:

* Customers may become annoyed that they are being charged a new fee.

* Merchants must follow very specific rules to make sure they are within compliance.

* Even though savings are large, pricing is not transparent due to the flat-rate nature of the fees being charged.

Subscription-Based Pricing

With so many options that favor processors and harm small businesses, there must be another way! Subscription-based pricing is our specialty. This pricing structure features the transparency of interchange plus pricing but without the profit being tied to the revenue of the business. Hard costs of interchange are passed through, and a monthly fee is assessed instead of a percentage. In this situation, the processor’s income is independent of the merchant’s revenue, making the processor a service provider instead of an unwelcome business partner.

| Card Type | Interchage Cost | Processor Fee | Processor Profit |

| Debit | 0.05% + $0.21 | 0.00% + $0.00 | 0.00% + $0.00 |

| Credit | 1.55% + $0.04 | 0.00% + $0.00 |

0.00% + $0.00 |

| Credit Rewards | 1.65% + $0.10 | 0.00% + $0.00 | 0.00% + $0.00 |

| Monthly Volume | Subscription Fee | Clover Point of Sale System |

| < $75,000 Monthly Volume | $49.99 | Not Included |

| < $150,000 Monthly Volume | $99.99 | FREE ($2,000 Value) |

| $150,000+ Monthly Volume | $149.99 | FREE ($2,000 Value) |

Pros:

* The cheapest pricing method besides cash discount for most merchants.

* Transparent fee structure that easily allows for independent verification.

* Processor income is not tied to the revenue of the merchant. When you earn more money in a month, you keep a greater percentage of that revenue.

Cons:

* Not always the best option for merchants who process low monthly volumes with large tickets (ex. $3,000 a month with just one sale). Flat-rate providers are often cheaper for small merchants with high tickets.

* Statements show hard costs (interchange) and thus may be confusing to read.

Explore Your Options with Synapse

Our team is full of experts in how payment processing works. Call us, and we’ll happily discuss the details of your business to see if subscription-based pricing could save you money each month. You can even upload your most recent merchant statement, and we’ll show you exactly how much profit your current processor is earning on your business. Contact us today for fair, transparent pricing.