Credit Card Processing Fees Explained

Interchange Plus Pricing is one of the most frequently used pricing models by merchant processors today. It is also one of the most difficult statements for business owners to read and understand. The most important question you should ask when working with a merchant processing company is “What am I paying for the services that I am receiving?”

But to answer this question, you need to know how to read a merchant statement. The ability to self-verify information is important to confirm that the processor is charging you fairly for the services they’re rendering.

To explain credit card processing fees, let’s look at an example. In this merchant statement, the client is using the First Data processing platform. First Data is one of the largest companies in electronic payments. Most First Data statements will use the same format.

The first page of a statement typically includes some basic information such as:

- The processor’s company logo

- The merchant’s name and address

- The merchant’s ID number

- A customer service phone number

- A summary of total volume and total fees

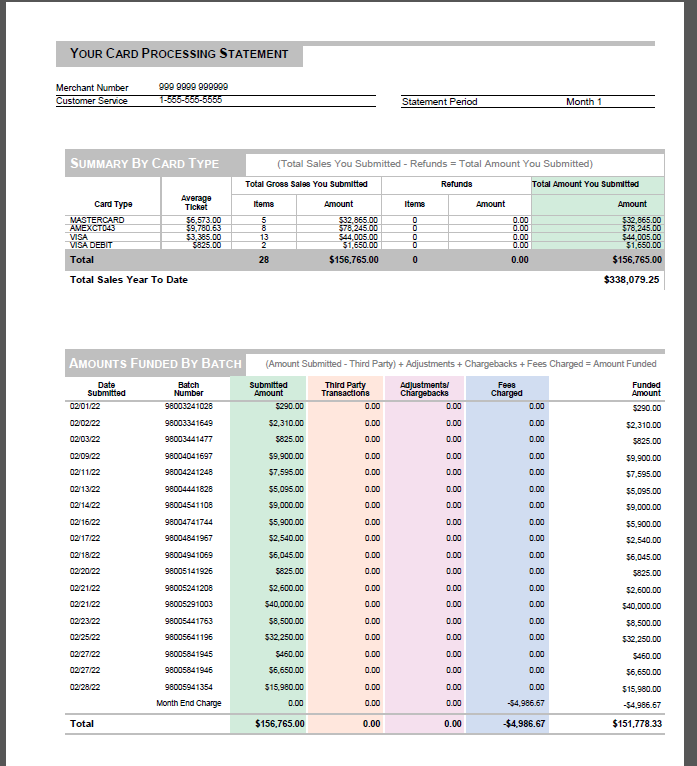

You will also find a breakdown of the total volume by card type and volume processed per day. Sometimes the revenue items for the processor will show up here and will be labeled with some variant of “Discount” or “Item Fee.” It’s important to learn the different definitions and terminology to learn how to read a merchant statement accurately.

Understanding Fees

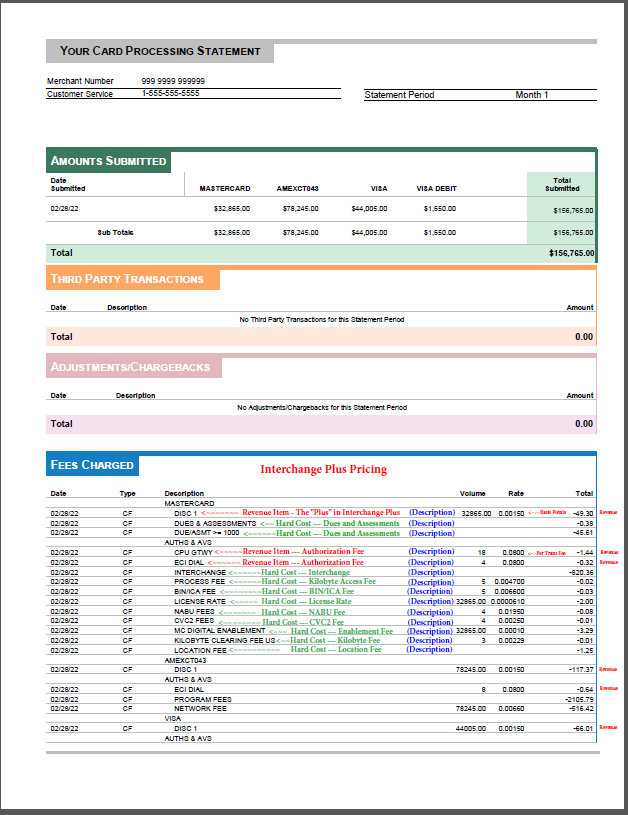

The most important page is the fees section. This section is made up of revenue items as well as hard costs that a processor incurs while processing transactions. If you want your credit card processing fees explained, it’s essential to understand this section.

In this example, we’ve labeled what is a revenue/profit item and what is a hard cost. Click on the hyperlinks to scroll down to more thorough explanations of each line item.

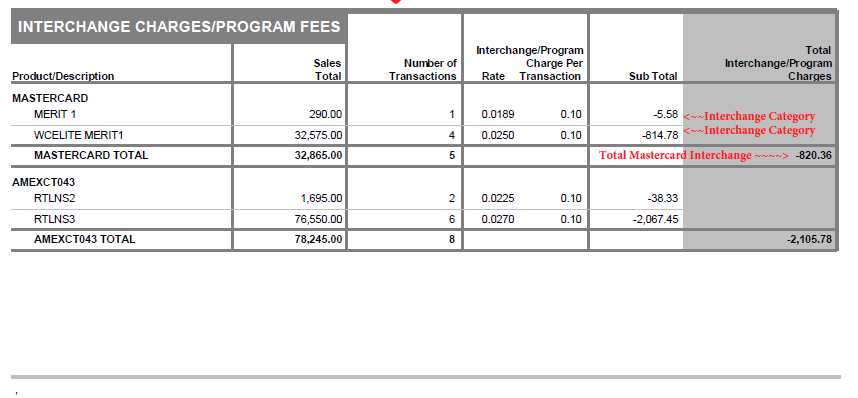

Finally, you should see a breakdown of the interchange costs for each card type that you accepted throughout the month. Some processors will report some card types as being one cost when they are actually cheaper in an effort to hide additional profit.

That’s why you should have all the credit card processing fees explained to verify that the costs being reported are the actual costs you pay. Luckily, each card brand publishes its costs every year. In our example, you would want to go to Mastercard’s Interchange Tables and verify that the costs being reported on the statement are the same as on Mastercard’s website.

In the above example, the merchant is paying interchange-plus 15 basis points and 8 cents per transaction. This is considered a competitive rate—in many cases, the merchant is priced at 35 basis points or more—but even at this “low” rate the processor still collects a whopping $238.76 per month (this is the red “processor total profit” number at the bottom of the statement). This processor profit figure also scales with the revenue of the business. So, if the business processes more, the processor earns more.

In addition to all of the fees on this statement, you may come across any number of “special” fees that are 100% revenue items for processors. They can name these fees whatever they want—such as “monthly statement fee” or “online reporting fee”—even if they don’t correspond to an actual service provided.

If you see this, make sure to have these credit card processing fees explained by your solutions provider so you understand why you are subject to these additional costs.

A Better Way to Process

Although Interchange Plus pricing is considered by many to be the industry standard in obtaining the cheapest rates, it is fundamentally flawed due to its scaling with the business. Interchange Plus is more like having a business partner than having a service provider. For a more specific example explaining credit card processing fees, see “How Do Credit Card Processing Fees Work?“

At Synapse, we do business differently. Our pricing tiers can save you hundreds of dollars each month, even if you currently use a “competitively priced” processor with Interchange Plus. Call us at 800-925-5191 or contact us online. If you’d like, you can upload your most recent merchant statement, and we’ll help you read it to determine exactly how much you’re overpaying. Plus, when you switch to Synapse, we’ll give you a statement you can easily understand.

Terms Defined

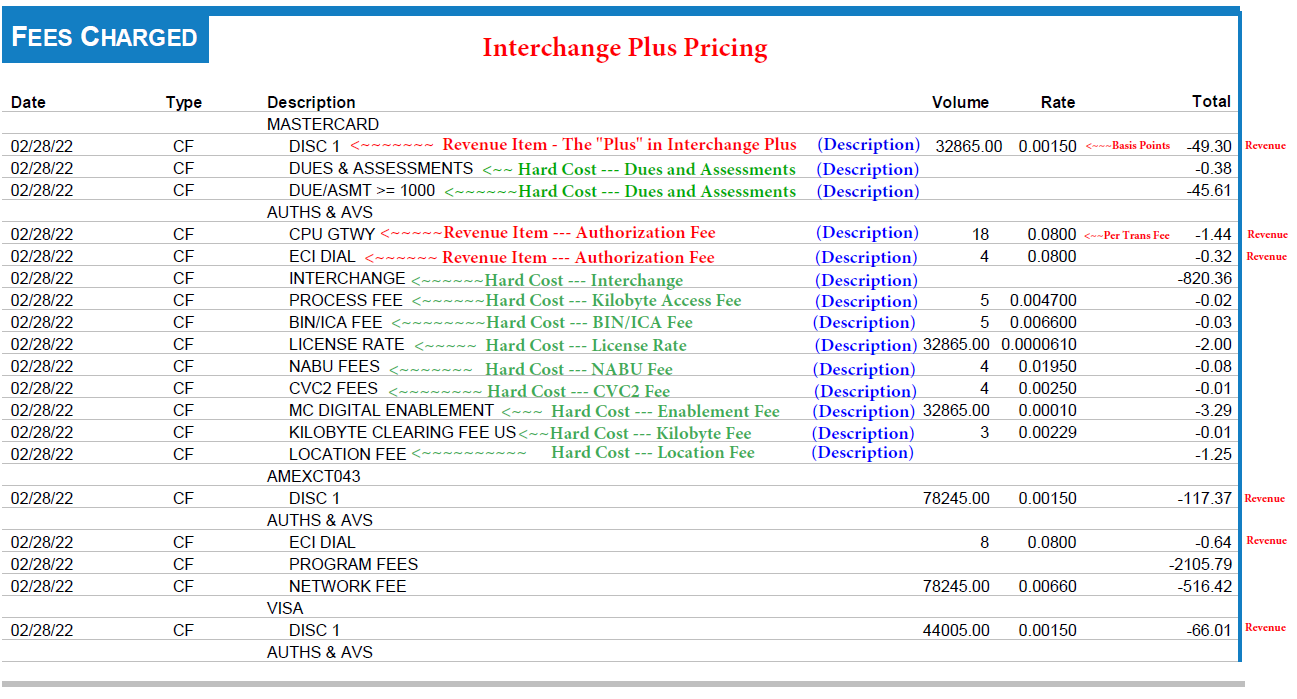

Disc 1 / Discount: Revenue Item

The discount rate on an Interchange Plus pricing structure represents the margin that is earned on the total volume processed. This figure is represented as a percentage and is often quoted in basis points. This merchant is priced at 15 basis points or .15% above cost. This rate usually represents the most significant fees earned by the processor.

CPU GTWY / ECI Dial / Per Item / Authorization: Revenue Item

When swiping or keying in a credit card on a terminal or Point of Sale System, the equipment reaches out to the processing bank which in turn reaches out to the issuing bank of the credit card to “Authorize” that the funds are available and puts a hold on the funds in anticipation of the merchant processor settling, usually at the end of the day (known as batching). The network between each party charges a fee per transaction for using their services. The transaction fee can range from $0.015 to $0.04 per transaction.

Dues & Assessments: Hard Cost

Each card brand (Visa, Mastercard, AMEX) has its own fees that they charge for using their brands. These fees may change from time to time. Using Mastercard as the example, they charge 0.1275% and $0.0195 for transactions that are under $1000 and 0.1475% and $0.195 for transactions over $1000. These are the “dues.”

The fees that would typically be classified as “assessments” are not always charged. These fees are mostly charged for more specific reasons and circumstances. So, it’s important to learn how to read a merchant statement to fully understand how much you’re being charged.

Interchange: Hard Cost

Interchange is the cost that is attached to each specific credit or debit card. This fee can vary tremendously depending on the card. For example, a rewards card has a higher fee than a non-rewards card. You can read more about this in our “How Processing Fees Work” post.

Bank Identification Number (BIN/ICA) Fee: Hard Cost

$0.0078 charged by Mastercard to processors. BINs are used to identify specific card ranges. For example, Debit cards from Chase will have a specific BIN.

License Rate / Acquirer Fee / Access Fee: Hard Cost

0.0047% charged by card brands for utilizing their network to process debit and credit cards. PIN Debit cards are not assessed with this fee.

Network Access Brand Usage (NABU): Hard Cost

$0.0195 per transaction for all non-PIN-based transactions for utilizing their network.

CVC2 Fees: Hard Cost

$0.0025 per transaction for utilizing the CVC2 (security code on the back of the card) verification service. This service is important for preventing fraud and the possible downgrade into a more expensive interchange category for the specific card.

MC Digital Enablement: Hard Cost

0.01% assessed on all card-not-present transactions.

Kilobyte Clearing Fee: Hard Cost

$0.0035 per byte of data that is settled. This fee covers the data charges.

Location Fee: Hard Cost

Mastercard charges an annual location fee to every merchant that accepts Mastercard payments. This fee is $15.00 per location per year.

Non-Receipt PCI SAQ / Non-Compliance Fee: Varied Cost

PCI stands for Payment Card Industry Compliance and SAQ stands for Self-Assessment Questionnaire. Every year, processors require that a merchant fill out an SAQ to determine whether they are operating and accepting payments that conform with Payment Card Industry Compliance Standards.

These questions usually relate to the method you use to accept cards and how you store saved credit card information, among other things. Frequently, we see fees of $19.95 per month, but we have witnessed fees as high as $195.00 per month. Merchants can avoid these fees by completing the questionnaire, which takes less than 5 minutes in most cases.